Burgundy Diamond Mines has revised its annual revenue forecast and is expecting its income to be between $430 million and $460 million. It is a decrease from the original projection of a maximum of $500 million. Analyzing the current tendency, we can say that it reflects the overall market slowdown. Experts attribute it to weakened demand and lower prices for rough diamonds. In contrast, the company’s third-quarter revenues increased by 30% and reached $118 million, with sales jumping by 80%. However, it should be mentioned that the average price per carat fell to $83, that is by 28%.

The company also adjusted its production forecast to 4.7 million to 5 million carats, while the earlier estimate was 4.9 million to 5.3 million. The decrease may be explained by the transition from the Sable site to the Point Lake open pit, which is currently processing lower-grade ore.

Burgundy Diamond Mines reported the recovery of some significant finds, including two diamonds: a 36-carat fancy-vivid-yellow stone and an 11.3-carat fancy-yellow gem. In general, the company’s rough-diamond reserve is valued at $73.2 million and comprises 1.1 million carats.

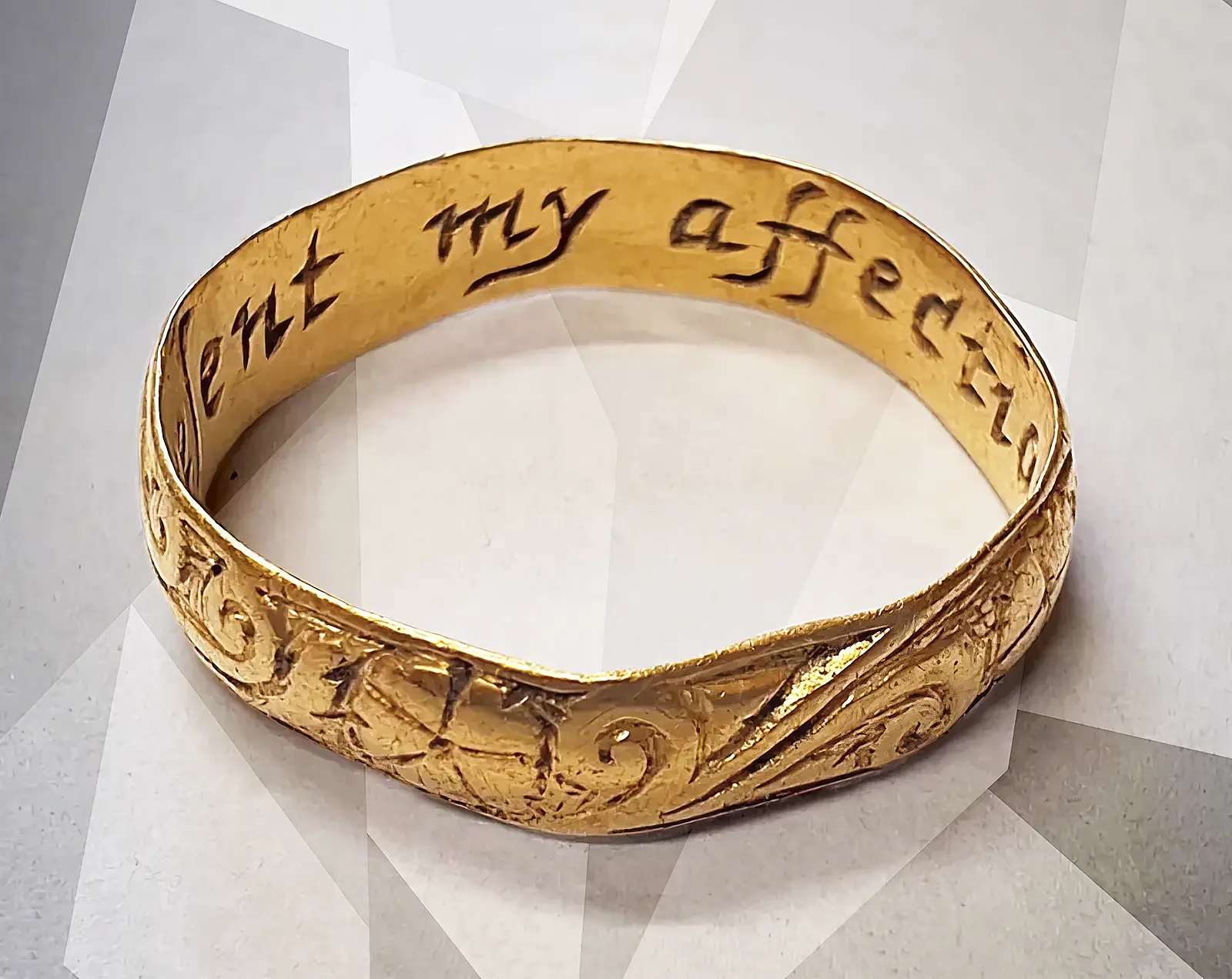

By the end of the year, Burgundy will hold two auctions. The second sale is planned to be of a larger scale than usual, incorporating leftover inventory and newly available rough stones. As the holiday season is around the corner and jewelry is one of the most common gifts, the bidding event is expected to be successful because retailers stock up to cover the increased demand.

Although the diamond market is currently experiencing challenges, the company representatives stated that stones from the Ekati mine continue to attract buyers and guarantee high sales performance rates.