In July and August 2018, Poland came up with a great way to increase its bullion reserves by purchasing 7 and 2 tons of gold respectively. However, this sizeable addition wasn’t the country’s largest purchase. Poland outperformed itself in 2019 by buying a whopping 100 metric tons of this precious metal.

Have Poles grown a sudden fascination with gold or are they just being strategic? NBP Governor Adam Glapiński has explained what guided the national bank to make this decision, “Why does the central bank own gold? Because it retains its value even if someone cuts off the supply to the global financial system. Of course, we don’t assume that this will happen. But as the saying goes – fortune favors the prepared. And a central bank must be prepared for the most adverse circumstances. That is why gold has a special place in our currency management process.”

The same trend is observed in other national economies of the European Union, with more and more countries taking the chance to stuff their vaults with gold as its price lowers. For example, in 2023, the Czech Republic increased its bullion reserve by over 37% and currently has the highest amount of gold in possession since 1998. As for Poland, its reserves have hit an all-time record high. With almost 360 metric tons of gold, the country now comes 15th among the highest holders in the world surpassing even such economic giants as Saudi Arabia, the UK, and Spain. Outside the euro region, there have been also some positive dynamics in the amount of gold in national economies, especially, in India, Kazakhstan, Russia, and the Philippines.

Marcin Mazurek, a senior economist at mBank SA, points out that the NBP reserve management policy seeks to tackle potential economic risks such as inflation. According to Natalie Dempster, managing director of central banks at the World Gold Council, “Central banks have three main objectives when they are thinking about reserve assets: to keep their assets safe, to keep their assets liquid, and to generate returns. Gold can help to meet all three policy objectives.” She also believes that national economies might gravitate more strongly toward gold to ensure their financial stability amid the unstable global economy. For example, the tug-and-pull dynamics between China and the U.S. might shift the dominant global currency from the U.S. dollar to the Chinese yuan.

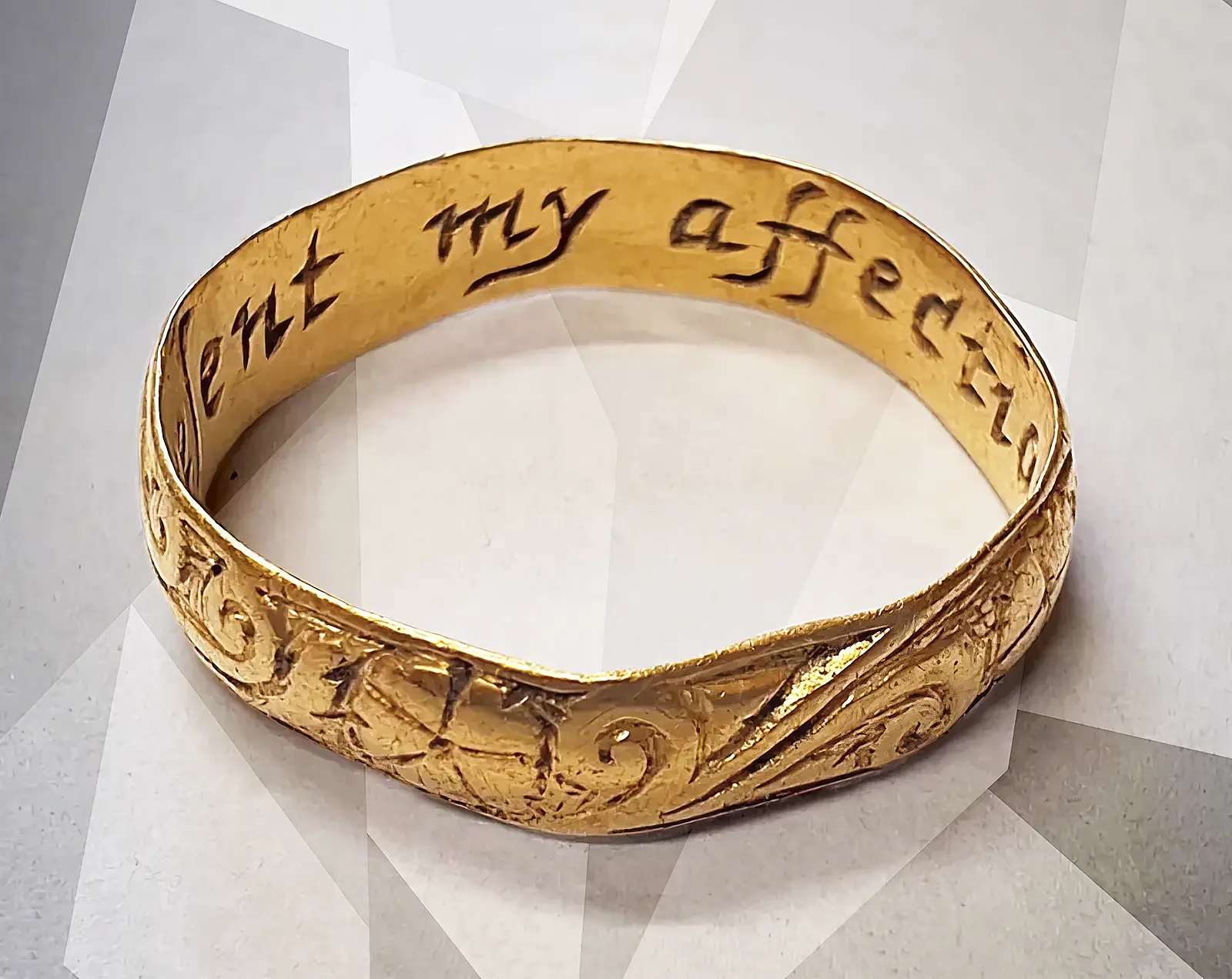

In a world of chaos with countless destabilizing factors such as wars and disasters, gold seems to be one of the few means of ensuring financial stability. Just as it was thousands of years ago. For all our technological advancements, have we really come a long way as a society in managing our economies?